Enjoy The Benefits

Partnering with a community foundation – a public charity - for your giving provides a ton of advantages that you wouldn’t get from either doing it on your own or through a private foundation.

MCF adds a level of service and expertise that makes the experience unbeatable. Our team tailors our services to exactly what you need so you make the most of your giving.

The Advantages of MCF

Global reach

We may be based in Marin, but our reach extends far beyond the county. We make thousands of grants annually on behalf of our donors to organizations based locally, nationally, and globally. And we handle all the administration and due diligence in doing so. Your interests don't have boundaries and neither should your philanthropy.

Flexible funding

Use any of these assets to open a fund or to add to an existing fund. It's that easy!

- Cash

- Securities, including publicly traded stock, publicly traded bonds, closely-held stock, restricted stock, and mutual funds.

- Real estate

- Personal property, such as art or jewelry

- Transfer of a private foundation or other philanthropic assets

- Royalties and distribution rights

- Business interests, including partnerships and interests in LLC's

- Bequests

- Life insurance

- Retirement plan assets

- Cryptocurrencies

Tax benefits

A donor-advised fund at MCF enjoys significant tax advantages over both informal giving and private foundations:

- Use cash gifts to fund your account and receive an immediate income tax deduction up to 60% of adjusted gross income.

- Use publicly traded securities to fund your account and receive an immediate income tax deduction of fair market value up to 30% of adjusted gross income.

- Use real estate or closely-held securities to fund your account and receive an immediate tax deduction of fair market value up to 30% of adjusted gross income.

There are no tax returns to file, no excise taxes to pay and no distribution requirements — all tasks that are required for private foundations.

Minimal administration

You can open a donor-advised fund at MCF within a couple of hours – and start making an impact immediately.

- No start-up costs.

- No minimum contribution.

- No distribution requirements.

Access and manage your fund 24/7 at our secure online Giving Center. Make grant recommendations, track gifts and grants, learn about opportunities, and more – all in one convenient location.

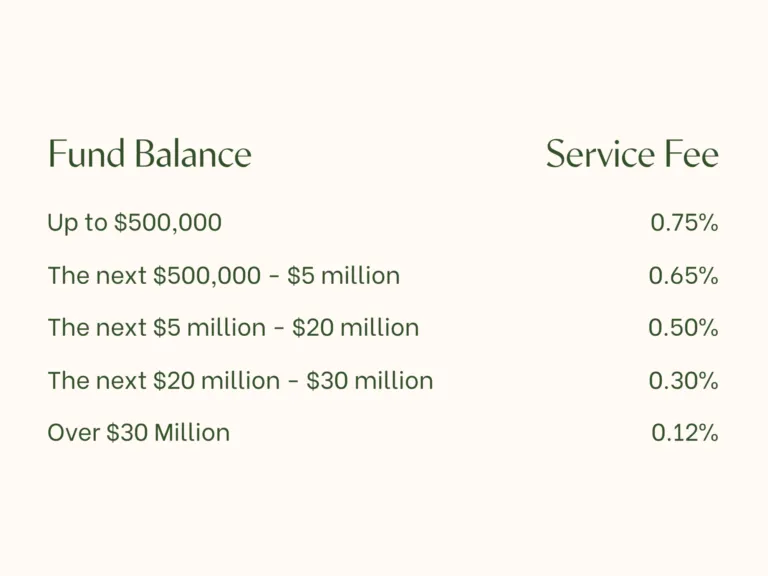

Competitive fees

We offer some of the competitive fees in the country. And there is never a fee for opening any type of fund at the foundation.

The fee schedule is designed using a sliding scale model, which begins at .75% for the first $500,000 and scales down to .12% as fund balances increase.

Investment fees

MCF does not charge any investment fees, but third-party fees charged by investment managers are passed through to each fund. These typically range between 5 and 100 basis points annually, depending on the donor’s investment allocation between the professionally managed investment pools.

Expense of the sale of gifts

When brokers, agents, or others charge fees for liquidating stocks or other assets - such as real estate - made as gifts to a fund, these fees are passed through the fund.

International grantmaking

Funds in The Family Office of Philanthropy enjoy complimentary international grantmaking three times annually; all other funds can access international grantmaking fo ra fee that covers the cost of due diligence.

Funds to choose from

Whether you're considering opening a donor-advised fund (DAF) to start your charitable giving now, or you're planning for the future, we have the options that help you make maximum impact.

Donor-Advised Funds (DAFs)

Hands down the most popular option for charitable giving, DAFs allow an individual, family, or business to contribute assets to a fund and then recommend grants at any time to support qualified organizations anywhere in the world. DAFs garner the maximum tax advantages allowed by law, and significantly greater than that allowed for private foundations. They can be opened quickly and easily and are incredibly streamlined to administer. DAFs are also the only charitable giving vehicle that allows donors to make grants 100% anonymously, so if you prefer to maintain privacy in your giving, you may. DAFs at MCF can live in perpetuity, meaning that you can establish a family tradition of giving that lasts forever.

Other types of funds

Supporting organizations

These are separate nonprofit corporations that operate under MCF’s status as a public charity. Through its own board, on which the donor(s) may choose to sit, a supporting organization can determine its own investment strategy and grants priorities. Alternatively, it can use MCF’s investment pools and ask MCF to invest the assets on its behalf.

Scholarship funds

These funds allow you to give the gift of education. MCF can help you establish an objective set of criteria to select individuals who receive scholarships. Scholarship funds may be established by an individual or a group.

Designated beneficiary funds

These funds support one or more organizations specified at the fund's inception. This is a way to ensure a specific organization will receive your support, for the purpose you intend, over any period of time you choose.

Committee-advised funds

These are funds established by one or more donors whose grants are recommended by a committee. The members of the committee do not have to be donors to the fund. However, all members of the committee have an equal voice in selecting grant recipients.

Field of interest funds

These funds allow you to identify an area of your philanthropic interest to support, without requiring you to specify any particular organizations. MCF’s philanthropic advisors can provide you with guidance should you need it, so that you can create a plan for giving within that issue arena.

Organization funds

These are designed for nonprofit groups, schools, or religious organizations as part of their overall fundraising strategy. Often this type of fund provides organizations with a way to establish an endowment into which their supporters can make contributions.

Imprint (Legacy Funds)

These are established by donors as part of their estate planning. Typically, all or part of the donor’s estate is left as a bequest to a charitable fund at MCF. The fund becomes a vehicle to accomplish the donor’s charitable wishes after they pass.

Charitable remainder trusts

Giving through a charitable remainder trust enables you to receive income for the life of the trust, with the residual going to the charities of your choice.

Charitable lead trusts

A charitable lead trust enables you to make significant charitable gifts now while transferring substantial assets to beneficiaries later.

Retained life estates

Turn your property’s value into community good through a charitable gift of real estate.

Gift of life insurance

For those whose need for life insurance has decreased, making a gift of an unneeded policy can be a convenient and effective way of meeting your charitable goals.

Retirement fund plans

People who have planned carefully for their retirement may find that the assets in their IRAs or other qualified plans exceed their needs. The remainder may be transferred to your fund at MCF, if so desired.

Investment strategies that deliver results.

MCF's investment strategy is designed to achieve superior returns while moderating risk to enable donors to maximize their philanthropic impact.